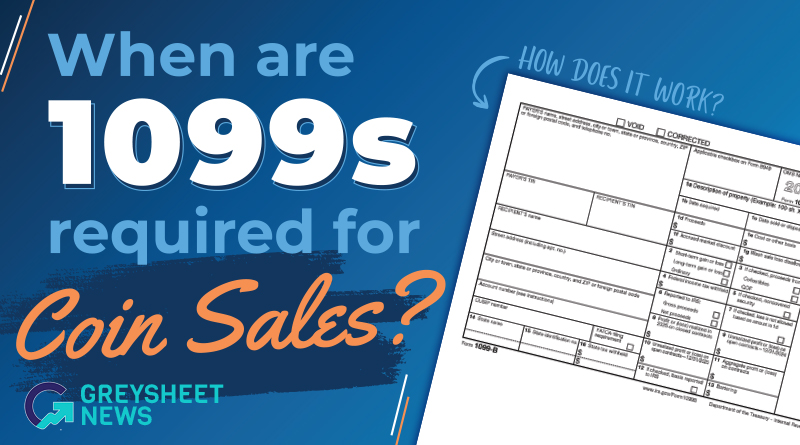

When are 1099s Required for Coin Sales?

A 1099-B form requires reporting the seller’s full name, address and Social Security number.

by Armen Vartian |

Published on December 11, 2025

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

Advertisement

Collectors and investors browsing the Internet, trade publications and newsletters often see dealers describe certain coins they are offering as "private gold" or "non-reportable" to the IRS, and other coins as "reportable." What does this mean, and is there anything to it?

The "simple" answer comes from the IRS:

"A sale of precious metal (gold, silver, platinum, or palladium) in any form for which the Commodity Futures Trading Commission (CFTC) has not approved trading by regulated futures contract (RFC) is not reportable. Further, even if the sale is of a precious metal in a form for which the CFTC has approved trading by RFC, the sale is not reportable if the quantity, by weight or number of items, is less than the minimum required quantity to satisfy a CFTC-approved RFC."

I didn’t make that up. It’s actually from this year’s instructions for IRS Form 1099-B. Gibberish for most coin collectors and investors, so what does it mean? Let’s start with the meaning of "reportable." It means that, in some instances, dealers buying coins from collectors or investors must report the sale of the coins to the IRS on a 1099-B form, which includes the name and tax ID of the seller and the amount paid for the coins.

Which coins are covered? The IRS’s instructions don’t say, but fortunately the CFTC does, although you’ll need some time on the computer to find a list. The coins are: South African Krugerrands, Canadian Maple Leaf gold coins, Mexican 50 Peso gold coins, and U.S. 90% (pre-1965) silver dollars, half dollars, and dimes. Note that modern U.S. bullion coins such as gold and silver Eagles are not on the list, and in my opinion coins bought and sold for numismatic value (rather than metal value) are also excluded.

Now that we know the coins, let’s look at the minimum quantities for "reportability." Back to the IRS:

"[A] broker selling a single gold coin does not need to file Form 1099-B even if the coin is of such form and quality that it could be delivered to satisfy a CFTC-approved RFC if all CFTC-approved contracts for gold coins currently call for delivery of at least 25 coins."

Again, not plain English, but we can decipher it. The CFTC-approved contracts for "bulk gold" require a minimum of one kilogram (32.15 troy ounces) weight at .995 or better fineness, which means that kilo gold bars or smaller bars adding up to a kilo or more are reportable on Form 1099-B, but smaller amounts are not. For gold and silver coins, the quantities are as follows:

- Gold Krugerand 1oz - 25

- Gold Maple Leaf 1oz - 25

- Gold Mexican 50 Peso - 25

- Silver 90% U.S. Dollars - 1,000

- 50¢ Silver U.S. Half Dollar (any type) - 2,000

- 10¢ Silver U.S. Dime (any type) - 10,000

So these are the coins and quantities that must be reported. The IRS takes the requirements seriously, and warns dealers against customers trying to evade their obligations by dividing up their sales into smaller units, saying that "Sales of precious metals for a single customer during a 24-hour period must be aggregated and treated as a single sale," and that even this time limit doesn’t hold where "the broker knows or has reason to know that a customer, either alone or with a related person, is engaging in sales to avoid information reporting."

Who cares about having to report their coin sales? A lot of people care, and not because they’re trying to hide their coin sales to avoid taxes on their profits. A 1099-B form requires reporting the seller’s full name, address and Social Security number. Of course, the IRS already has this information, but the dealer buying the coins might not, and for many people the fewer third parties that have their personal information, the better. So while everyone must pay taxes on profits they earn from selling precious metals, which precious metals you purchase determine what information you may have to disclose later.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments