Florida Eliminates $500 Threshold for Bullion Sales-Tax Exemption

Florida has officially removed the $500 minimum purchase requirement for its sales-tax exemption on gold, silver, and platinum bullion.

Effective August 1, 2025, this important policy change allows all qualifying bullion purchases to be tax-exempt, regardless of the transaction amount.

The change was enacted through House Bill 7031, which was signed into law by Governor Ron DeSantis following strong bipartisan support in the Florida Legislature.

Previously, only purchases exceeding $500 in a single transaction qualified for the exemption, leaving smaller purchases subject to sales tax—a policy that disproportionately burdened small investors, collectors, and dealers. The elimination of this threshold levels the playing field for these consumers while also aligning Florida with a growing number of states that offer full sales-tax parity for precious-metals buyers.

Under Florida Administrative Code Rule 12A-1.0371, the $500 threshold had applied to certain taxable sales of coins, currency, and bullion. While that threshold no longer applies to gold, silver, or platinum bullion, the $500 threshold may still apply to other items, including certain world or ancient coins and collectible currency that do not meet the bullion exemption criteria.

This legislative change marks a significant milestone in reducing tax burdens, encouraging investment, and improving fairness and accessibility in Florida’s precious-metals market.

For more information, visit Florida Administrative Code Rule 12A-1.0371 and Florida Statute 212.08(7)(ww). (Please note that the online versions may not yet reflect the changes enacted by House Bill 7031, effective August 1, 2025.)

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

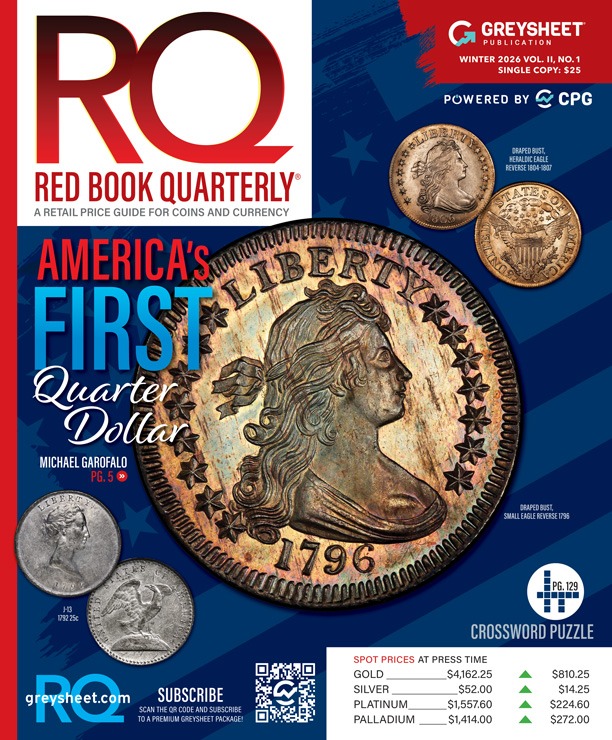

Subscribe to RQ Red Book Quarterly for the industry's most respected pricing and to read more articles just like this.

Source: National Coin and Bullion Association

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments