Editor's Message: Red Book Quarterly Fall 2025

Confidence in the rare coin and precious metals market goes beyond the optimism stemming from the price action of gold and silver.

I greatly enjoy when I have the opportunity to write live from a coin show, and I write this as I attend the World’s Fair of Money® held by the American Numismatic Association. This year’s convention is taking place in Oklahoma City. As a first-time visitor to this city, I find it very pleasant and despite some general industry trepidation about the location, it works just fine. The buying and selling, by all reports, has been solid and quite active, which in my opinion is a direct reflection of the current state of the collectibles market. While the many eyes and ears that have been focused on the traditional equity markets have done so with caution and discretion due to global uncertainties, the majority of the participants in the collectibles market have remained confident. This confidence in the rare coin and precious metals market goes beyond the optimism stemming from the price action of gold and silver. As with everything, this confidence is not without risk. As can be observed in the collectible sports and—especially non-sports card—markets, they can become frothy. This includes excessive speculation, which leads to little or no actual price discovery. Recent reports from major trading card conventions describe how collectors were buying at such a rate that there was little regard or rationale as to what prices they were paying. The act of acquiring something outweighed the price being asked. There is also an interesting trend of what’s known as "repacks," in which certified cards are sold blind, with the buyer essentially gambling as to what card they pull. This repack market is augmented by a theoretical buyback offer on behalf of the seller which pays the buyer up to 85–90% of the "fair market value" of whatever item they pull. Certainly, one can see the possible allure of this applied to collectible coins. Imagine the chance to buy an 1895-O Morgan dollar for the price of an 1881-S. And yes, there are some products like this already on the numismatic market, and fundamentally there is absolutely nothing wrong with them, provided the buyer fully understands the product that they are buying and has at least a decent grasp of the probabilities involved. At that point it is the decision of the buyer to evaluate whether they take the shot or spend their collecting funds on a piece they can see and research. When it comes to the idea of a guaranteed buyback, it begs the question: who sets the fair market value? If it is simply stated as a percentage of "comps" it becomes a situation that can be gamed. What happens when an item sold at $400, but nine days later one sells at $250, and then shortly after a sale at $200? Any buyer will attempt to use the lowest price as a basis for their offer; that is natural. But in today’s market sales results do not exist in a vacuum, and there are a number of factors that must be taken into consideration when trying to determine market value. This is why independent, data-driven pricing information executed by those with real-world trading experience is so critical and is one of the major advantages the rare coin market has over other collectible categories. Along with this Red Book Quarterly™ and all the other guides produced at Whitman Brands, we view this as a responsibility of the highest order. The rare coin market is in a great place, and as more neophyte collectors from other categories discover our market, this strength will only continue.

Sincerely,

Patrick Ian Perez

patrickp@whitmanbrands.com

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

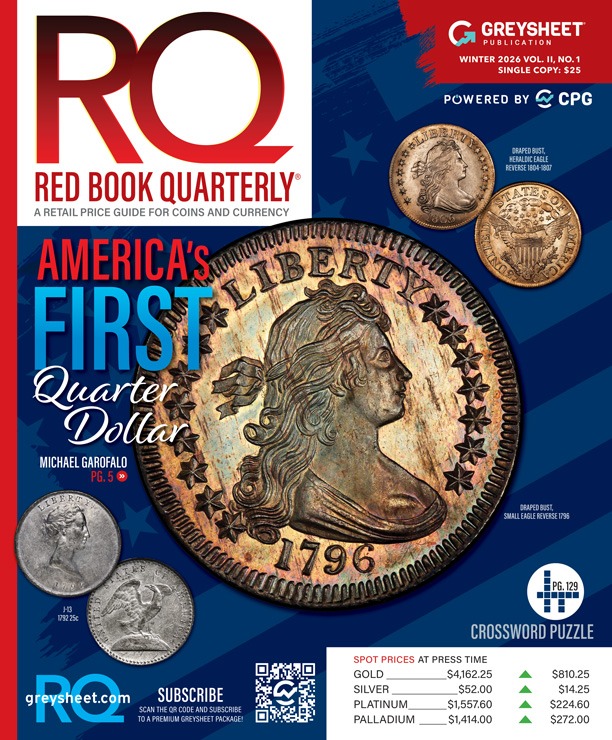

Subscribe to RQ Red Book Quarterly for the industry's most respected pricing and to read more articles just like this.

Author: Patrick Ian Perez

Patrick Ian Perez began as a full time numismatist in June of 2008. For six years he owned and operated a retail brick and mortar coin shop in southern California. He joined the Coin Dealer Newsletter in August of 2014 and was promoted to Editor in June 2015. In the ensuing years with CDN, he became Vice President of Content & Development, managing the monthly periodical publications and data and pricing projects. With the acquisition of Whitman Brands, Patrick now serves as Chief Publishing Officer, helping our great team to produce hobby-leading resources.

In addition to United States coins, his numismatic interests include world paper money, world coins with an emphasis on Mexico and Germany, and numismatic literature. Patrick has been also published in the Journal of the International Bank Note Society (IBNS).

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments