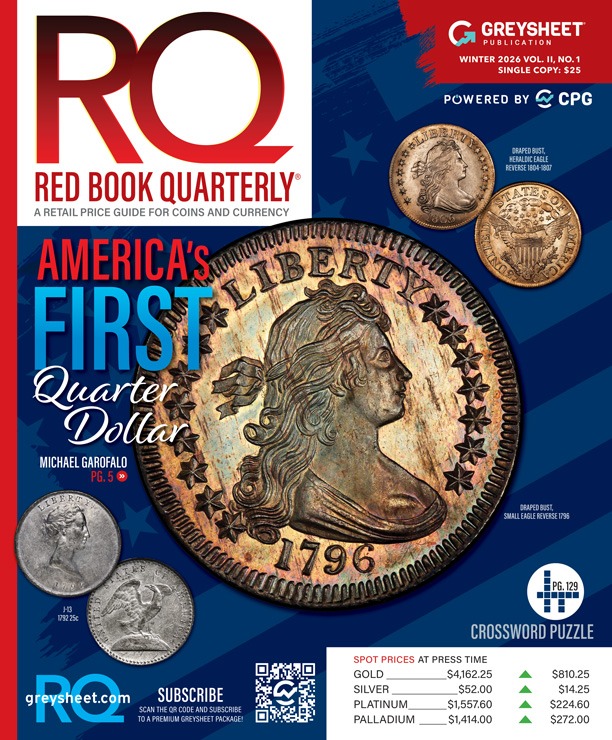

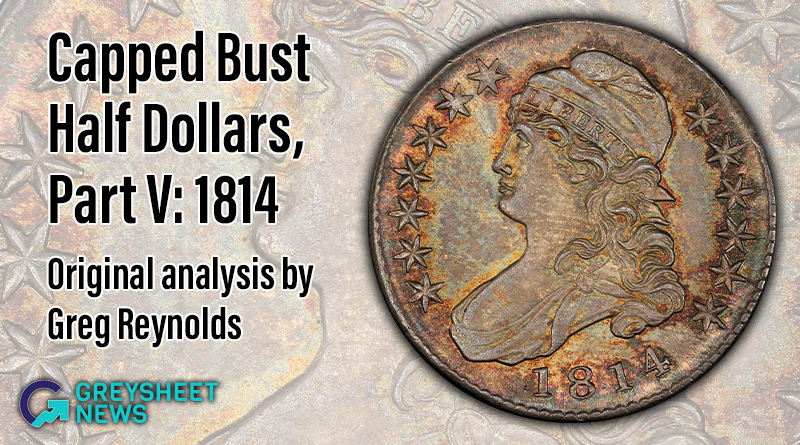

A Deep Analysis Of Capped Bust Half Dollars, Part 5: 1814

In this article Greg Reynolds analyzes a semi-key date in the Capped Bust Half Dollar series, 1814.

Time has passed since the publication of Part 3, 1811/0 with period, and Part 4, the 1814/3 overdate, in this series. Capped Bust half dollars continue to endure as one of the most popular series of classic U.S. coins. Indeed, during the first half of 2024, many Capped Bust halves have risen in value while most classic U.S. silver coins trended downward. In Part 1, the requirements for a set are itemized. The topic here in part 5 is the 1814 regular date.

The 1814 regular date should not be confused with the 1814/3 overdate, which was discussed in part 4. It is sad that a regular date, which is not characterized by repunching in the die or by visible unusual numerals, is typically called a normal date! The use of the term normal for regular numerals incorrectly implies that overdates and pertinent anomalies, like a small numeral, are abnormal. Almost all such varieties stem from standard practices and procedures of the first U.S. Mint and are factors in the personalities of coins. They are not abnormal. Readily apparent minting anomalies are often seen on U.S. coins dating before 1836.

As a result of varieties relating to numerals receiving so much attention, early Capped Bust halves with a regular date are often overlooked. A Capped Bust half with regular numerals and no very noticeable anomalies is less likely to be accompanied by commentary than a Capped Bust half from the same year that is an overdate or features noticeable peculiarities.

Strangely, the 1814 “E/A” variety is listed in several major guides as a major variety, a coin that is needed for a set by date. This is a mistake, in my view. This overletter is so subtle that a rather sophisticated analysis of several representatives of this variety would be needed to determine that an ‘E’ was punched over an ‘A,’ if that is really what happened. Moreover, at a glance, it only appears as if the die was roughly tooled in the inner portion of the letter ‘E’ in ‘STATES.’ On “E/A” 1814 halves, there are crude blobs of raised metal that should not be there. All this pertains to just one letter on the reverse and is an anomaly that most interested collectors would not regard as important if it was not itemized in standard guides. This is one of a very large number of very minor varieties in the series of Capped Bust halves, most of which are ignored by most collectors of Capped Bust halves.

It makes no sense for the “E/A” variety to be itemized in standard guides as if it is a distinct date, a third date from the same year, along with the 1814 regular date and the 1814/3 overdate. For a set by date or by major variety, I recommend against paying any premium for an “E/A” variety 1814 half; it does not make logical sense to do so. In contrast, the “E/A” variety may have considerable value to someone who seeks representative coins of all or nearly all die pairings used in the whole series of Reich Lettered Edge Capped Bust halves (1807-36). Collecting by die pairing is an activity for very experienced, science-minded and studious collectors who have a great deal of patience. This series on Capped Bust halves relates to collecting by date, including readily apparent varieties relating to the numerals in the year.

Population of 1814 Half Dollars

Reportedly, more than one million 1814 halves were minted. This total includes 1814/3 halves. It is likely that fewer than ten thousand survive, including both 1814 regular date and 1814/3 overdate half dollars.

PCGS reports 1,406 1814 regular date half dollars and the NGC census is 889, as of August 15, 2024. It is not often discussed, though, that NGC has encapsulated an additional 687 in Details holders, coins that failed to receive numerical grades due to serious problems. Probably, there are hundreds of 1814 halves in PCGS Details holders, too. There are, however, many 1814 halves that have been submitted more than once to PCGS, to NGC, or to both PCGS and NGC. It is fair to theorize that the total NGC, PCGS and CACG certified population of different 1814 regular date half dollars is less than two thousand.

It is also true that there are many that are not encapsulated. There are two main reasons for such raw 1814 halves being around. First, Greysheet Bid for a G4 grade 1814 is $90 or so. After consideration of a grading fee, shipping both ways, and the time it takes to process a submission, many dealers will figure that it is not cost-effective to send a G4 or lower grade 1814 to PCGS, NGC or CACG. Although such certification will usually increase a coin’s market value, the increase in market value in many cases would be less than the costs of certification. Also, a coin that a dealer thinks will merit a G4 grade might be returned in a Details holder and he might then end up swallowing the entire costs of such a submission.

Secondly, there are many collectors of coins that grade less than XF who like for their coins to be raw, thus not encapsulated. Such collectors like to hold and closely examine their coins. Others are irritated by the holders. Collectors of early American material who prefer raw coins tend to be drawn to circulated Capped Bust halves. In my estimation, however, many such collectors end up unknowingly buying coins that have serious problems.

Grading coins in the AG3 to F12 range is less complicated than distinguishing between MS65, MS66 and MS67 grades. It is not difficult to learn to grade heavily circulated coins, though experience and proper advice are needed. In some cases, contact marks have been filled or scratches have been artificially smoothed. Unnatural color can be an issue regarding raw coins, though is often an issue with certified coins as well. Nevertheless, as heavily circulated Capped Bust halves tend to be relatively inexpensive, a grading mistake is unlikely to be very costly.

Greysheet Bid for G4 grade 1814 halves was increased from $30 to $32 on May 9, 2003 and reached $48 on February 9, 2007. During the coin market boom from 2003 to mid-2008, the value of these increased by around 50%, unsurprisingly. It was odd, though, that Greysheet Bid for G4 grade 1814 halves inched to $50 in April 2016, while coin markets were sliding downward. The jump to $80 in March 2022 is very curious, as the boom in rare date gold from 2021 to 2023 was not accompanied by a boom in demand for scarce U.S. silver coins overall.

On August 31, 2022, Greysheet Bid for G4 grade 1814 halves slightly increased from $80 to $82. It is especially interesting that Greysheet Bid for G4 grade 1814 halves moved to $90 on July 29, 2024, as the values of many classic U.S. silver coins declined during the first half of 2024.

Very Good to Fine grade 1814 halves do not cost that much more than G4 grade 1814 halves. On March 24, 2023, Stack’s Bowers sold an NGC graded Fine-12 1814 for $168. Less than three weeks earlier, this same firm sold a PCGS graded F15 1814 for this same price, $168.

VF20 grade 1814 half dollars have dramatically increased in price since 2001. Greysheet Bid was $56 in November 2003, and was $210 at the end of July 2024, more than twice its value a dozen years earlier.

On September 25, 2023, Heritage sold a PCGS graded VF20 1814 of an often found die pairing (O-102) for $240. The next day, Heritage sold an NGC graded VF25 1814 for $264.

On April 10, 2024, Stack’s Bowers sold a PCGS graded VF30 1814 for $384. On April 7, 2023, Heritage sold an NGC graded VF35 1814 for $504, a strong price.

On March 19, 2024, Heritage sold an NGC graded XF40 1814 for $606. On April 9, 2024, Heritage sold a PCGS graded XF45 1814 for $664. On July 24, 2024, Stack’s Bowers sold an NGC graded XF45 1814 for $750.

I am not recommending for or against any of the specific coins mentioned. A point here is to provide an idea of the prices realized for 1814 halves in a range of grades in Heritage, Stack’s Bowers and GreatCollections auctions. Whenever practical, it is a good idea to view the coins beforehand or to hire a consultant to do so.

Research-minded collectors may note that there are some recent auction results with prices realized that are higher than those cited here for other 1814 halves with the same certified grades. Some collectors pay premiums for coins of relatively rare die pairings or for coins that are colorful.

It may need to be repeated that this discussion is about collecting by date, not by die pairing. While partly bounded by traditions and cultural phenomena, collecting activities are largely a function of the respective personalities of individual collectors. A goal that makes sense to one collector might seem obscure to another.

Opinions about individual coins vary, too. Knowing a coin’s date, type, die pairing and certified grade is not enough to know the value of the respective coin.

On July 1, 2024, Heritage sold three PCGS graded AU50 1814 halves, for $1,020, $990 and $750, respectively. These represent three different die pairings, though not one of the three is especially rare. Regarding ratings of rarity of die pairings used by Capped Bust half researchers, the coin that brought $990 is scarcer than the other two, though certainly not rare. Also on July 1, Heritage sold a PCGS graded AU53 1814 half for $960, less than the prices realized for two of the just mentioned PCGS graded AU50 1814 half dollars.

On April 1, 2024, Heritage sold a CAC approved AU55 grade 1814 for $1,530. On March 29, an NGC graded MS62 1814 brought $1,920.

On April 3, 2024, Stack’s Bowers sold two PCGS graded MS64 1814 halves, in successive lots, for $4,800 and $7,800, respectively. Although the 1814 half that brought $7,800 is of a scarcer die pairing, coins struck from that die pairing are very common. There was probably at least one additional reason for the large discrepancy in prices realized in the same auction for two coins of the same date and type with the same PCGS grade.

As for 1814 halves that have been certified in the MS65 to MS68 range, there are a sizable number, and the population data includes some multiple counts of individual coins. Moreover, the quality of these differs dramatically. In some cases, a certified MS65 grade coin may be of much higher quality than a certified MS66 grade 1814 half dollar, in my opinion. I have seen most of them. These really need to be analyzed as individuals. Collectors who are interested in buying a gem quality 1814 half should consult experts and not take the certified grades too seriously.

Stack’s Bowers auctioned a PCGS graded MS65 1814 half for $19,200 in November 2020 and another for $8,400 in June 2024. The coin that brought $8,400 is of a much scarcer die pairing than the coin that brought $19,200. It is important to see coins in person.

On January 8, 2009, an NGC graded MS68 1814 brought $80,500. On May 31, 2012, this same coin was auctioned by Heritage for $43,125. Market levels for Capped Bust halves were much higher in May 2012 than they were in January 2009. There are many variables, not just market levels, that affect auction results.

On October 27, 2014, Heritage auctioned a PCGS graded MS66 1814 from the Gene Gardner Collection for $21,150. It did not have a CAC sticker in 2014. Later, this same coin was upgraded by PCGS to MS66+ and then received a CAC sticker. It was auctioned by Legend in 2022 for $36,425.

One of my favorite 1814 halves is the CAC approved, PCGS graded MS66 Pittman-Pogue coin. In September 2015, it realized $30,500. In September 2021, this same coin realized $61,687.50. In my view, this 1814 is more than very attractive and scores well in the category of originality. The orange-russet and green tones are very appealing. It also scores highly in the technical category, really an excellent coin overall.

Prices realized for gem quality 1814 halves in general reinforce the point that Fine to XF grade 1814 halves cost just small fractions of the values of certified MS65 and higher grade 1814 halves. As for which 1814 halves are better values, this depends upon the specific coins being considered, collecting budgets, and the personalities of the respective collectors who seek Capped Bust halves. Coin collectors should pursue coins that they like and can afford, without stretching.

Copyright ©2024 Greg Reynolds

Insightful10@gmail.com

Images are shown courtesy of Heritage Auctions (ha.com) and Stack’s Bowers Galleries (stacksbowers.com).

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to RQ Red Book Quarterly for the industry's most respected pricing and to read more articles just like this.

Source: Greg Reynolds

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments